South Africa is one of the countries with the richest mineral resources in the world, attracting a large number of Chinese-funded enterprises to invest in the mining industry there. However, due to the complexity of policies and systems, significant cultural differences, and prominent social contradictions, many enterprises have fallen into a situation of “incompatibility with the local environment” in the absence of local experience, and even suffered serious financial and legal losses.

This paper summarizes the ten most common “pits” in the mining investment process of Chinese enterprises in South Africa, and puts forward practical and feasible “pit avoidance” strategies for the reference of the majority of enterprises.

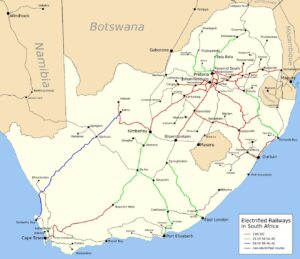

1. BEE Policy Compliance Traps (Maximum Risk)

Problem Analysis

According to the requirements of the Mining Charter:

- Enterprises newly obtaining mining rights must hold at least 30% of the BEE equity.

- Enterprises that held 26% of BEE’s shareholding before September 27, 2018, need to increase it to 30% within five years.

- At the same time, obligations such as local procurement, employment and community development must also be fulfilled.

Once the standards are not met, enterprises will face the serious consequence of having their mining rights revoked.

Suggestions for avoiding pitfalls

- Design a compliance framework in advance: Form a joint venture with a compliant BEE partner before the acquisition of mining rights;

- Adopt flexible shareholding methods: For instance, achieve BEE empowerment through controllable structures such as “equity trusts” to reduce the risk of long-term control loss.

2. Labor Conflicts and Strike Risks

Problem Analysis

South African trade unions are powerful (such as NUM and AMCU), and mining strikes occur frequently, bringing about:

- Huge production halt losses (with daily losses reaching several million rand);

- Even intense social conflicts (such as the Maricana incident in 2012).

Suggestions for avoiding pitfalls

- Hire local Labour relations consultants to pre-negotiate long-term wage agreements with trade unions;

- Respect labor culture, avoid “Chinese-style tough management” and establish a consultative management mechanism.

3. Community Protests and Land Disputes

Problem Analysis

The communities around the mining area often protest against the closure of the mine due to issues such as employment, the environment and land compensation, and even take legal measures.

Suggestions for avoiding pitfalls

- Take the initiative to sign a Community Development Agreement (SLP) that specifies investment commitments and employment plans;

- Establish communication mechanisms with traditional authorities (such as tribal leaders) to build long-term mutual trust.

4. Environmental protection laws and regulations are strict, the cost of violation is high

Problem Analysis

Environmental regulations in South Africa (such as the National Environmental Management Act NEMA) are strictly enforced. Illegal acts may result in:

- Fines up to 10% of the project investment;

- Halted projects and revoked permits.

Suggestions for avoiding pitfalls

- Conduct a complete ESG compliance review before investing;

- Hire local environmental consultants to eliminate the practice of “filling procedures while construction”.

5. Power Shortage and Insufficient Infrastructure

Problem Analysis

The power supply of the state power company Eskom is unstable, and the rotational power rationing has a significant impact on the mining industry.

Suggestions for avoiding pitfalls

- Equipped with backup generation systems (such as solar and diesel units) to reduce dependence;

- Give priority to mining areas close to ports or railways to optimize logistics.

6. Frequent changes in laws and policies

Problem Analysis

South Africa’s mining laws and policies may be temporarily adjusted (such as an increase in the BEE ratio and changes in tax burden), which will directly affect the return on investment.

Suggestions for avoiding pitfalls

- Take out political risk insurance;

- Include a “policy change compensation clause” in the investment agreement.

7. Local procurement requirements increase costs

Problem Analysis

The Mining Charter requires that more than 70% of Mining Goods be provided by local suppliers, but local manufacturing in South Africa is costly and inefficient.

Suggestions for avoiding pitfalls

- Lay out the supply chain in South Africa in advance and cultivate long-term partners;

- Apply for the “Critical Equipment Exemption” clause to reduce the procurement burden.

8. Exchange Rate Fluctuations and Restrictions on Capital outflow

Problem Analysis

- Volatile exchange rate of the South African rand (ZAR);

- Strict foreign exchange controls make it difficult to repatriate profits to China.

Suggestions for avoiding pitfalls

- Combine the use of offshore accounts with local financing;

- Cooperate with South African banks to optimize the capital structure and cross-border transfer strategies.

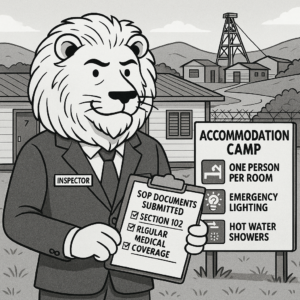

9. High Public security Risks (Frequent theft and robbery)

Problem Analysis

The security situation in some mining areas of South Africa is severe, and security incidents such as equipment theft and personnel being robbed often occur.

Suggestions for avoiding pitfalls

- Hire experienced armed security companies for round-the-clock patrols;

- Purchase commercial crime insurance to cover property damage.

10. Insufficient due diligence leads to mistakenly entering “problem mines”

Problem Analysis

Some mining rights are subject to major risks such as exaggerated reserves, unclear property rights and debt disputes. Chinese-funded enterprises have suffered significant losses due to insufficient due diligence and misjudgment of the situation.

Suggestions for avoiding pitfalls

- Engage local mining lawyers and geological experts to jointly conduct due diligence;

- Require the seller to provide a “Declaration of No Dispute over Property Rights” to enhance legal protection.

Conclusion: How to avoid falling into traps in South African mining Investment?

- Compliance first: Complete key compliance designs such as BEE, labor, and environmental protection ahead of schedule;

- Localized operation: Form a local core management team in South Africa to avoid maladjustment to the local environment;

- Risk hedging mechanism: Reduce systemic risks through insurance, contract terms, and financing tools.

If you are considering investing in the South African mining industry, please feel free to contact Peakpoint Advisory. We will assist you with a professional team to build a compliance framework, avoid potential risks, and ensure the stable implementation of cross-border investments.

📞 Welcome to contact:

📧 admin@peakpointadvisory.co.za

🌐 www.peakpointadvisory.co.za